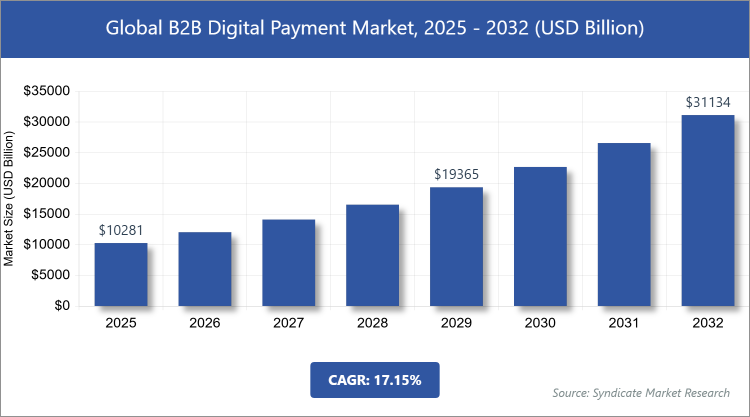

According to Syndicate Market Research, the global B2B digital payment market was valued at around USD 8775.98 Billion in 2024 and is projected to expand from USD 10281.06 Billion in 2025 to USD 31133.93 Billion by 2032, achieving a compound annual growth rate (CAGR) of approximately 17.15% from 2026 to 2032. This comprehensive B2B digital payment industry research report delivers a detailed, step-by-step analysis of the market landscape, providing essential insights for stakeholders, investors, and industry leaders. The study encompasses key elements such as market size, primary growth drivers, emerging trends, competitive forces, and long-term forecasts to guide strategic decision-making.

Global B2B Digital Payment Market: Overview

The term "B2B digital payments" refers to the financial transactions that take place between businesses for the exchange of products or services. In their most basic form, B2B payments include the exchange of monetary value for the purchase of goods or services between two firms. A consumer is not involved in this form of transaction, which falls under the category of inter-commerce.

Paper checks have been gradually being replaced by digital payments and invoices in business-to-business (B2B) transactions all over the world. The transition from paper checks to digital payments, which utilize the most recent technology and innovations, is uncomplicated and uncomplicated to carry out. As market participants move toward solutions that are both faster and more competent, it is only a matter of time before business-to-business (B2B) transactions become genuinely global and digital in nature.

Global B2B Digital Payment Market: Key Growth Drivers

Efficiency drives B2B digital payment solution adoption. Electronic invoicing, real-time transactions, and automated payment systems eliminate human errors and processing times, improving financial operations. Businesses want to cut check and wire transfer fees. Businesses can save time and money on processing fees and administrative costs with digital payments.

Restraints

Data breaches, hacks, and fraud threaten B2B digital payments. Businesses worry about financial transactions and sensitive data. Legacy payment systems and processes are common in large companies. The complexity of switching to digital payments and resistance to change can slow uptake.

Opportunities

Blockchain and cryptocurrencies could transform B2B payments with transparency, security, and speedier transactions. Integrating blockchain and cryptocurrency technologies can expand market potential. Emerging markets offer development opportunities as organizations seek efficient and scalable digital payment systems.

Challenges

The frequency and sophistication of cyberattacks continue to confront B2B digital payment security. Strong cybersecurity is essential. Complex legislation and compliance requirements govern cross-border transactions. This regulatory framework might be difficult for foreign commerce enterprises.

Global B2B Digital Payment Market 2024 Size by Region

Get more information about this report - Request Free Sample Copy

Global B2B Digital Payment Market: Segmentation Analysis

B2B digital payment market is classified on the basis of type of transaction, business segment, and operating channel.

On the basis of transaction type, the market is segmented into traditional and digital types. In terms of business segment, the B2B digital payment market is divided into the small sized-business, medium-sized business, and large-sized business.

On the basis of operating channel, the market is segmented into cross-border, and domestic. Owing to the pandemic, the B2B cross-border payment market growth is weakened. Industries are now more aware of the cost.

Global B2B Digital Payment Market: Regional Analysis

In the B2B Digital Payment market, North America is a major player due to its technologically sophisticated business environment and the presence of key players. Factors that have contributed to its expansion. Digital payment solutions have been rapidly adopted by businesses in North America, with a strong preference for secure and efficient payment methods. The expansion of the region is facilitated by ongoing investments in blockchain technology, digital infrastructure, and fintech enterprises.

In contrast, the European Union has established regulations to encourage open banking and digital payments, thereby nurturing a favorable environment. Businesses in Europe gain from digital payment solutions that facilitate international transactions within the European Union.

Asia-Pacific is a dynamic region in the B2B Digital Payment market, experiencing robust development due to the adoption of digital payments to streamline B2B transactions by rapidly expanding economies such as India and China. Mobile payment applications and the widespread adoption of smartphones have expedited the transition to digital payment methods.

| Report Attributes | Report Details |

|---|---|

| Report Name | B2B Digital Payment Market |

| Market Size in 2024 | USD 8775.98 Billion |

| Market Size in 2025 | USD 10281.06 Billion |

| Market Forecast in 2032 | USD 31133.93 Billion |

| Growth Rate (2026-2032) | CAGR of 17.15% |

| Base Year | 2025 |

| Historical Year | 2020 - 2025 |

| Forecast Year | 2026 - 2032 |

| Number of Pages | 256 |

| Report Coverage | Revenue Forecast, Market Dynamics, Company Profile, Competitive Landscape, Recent Developments, Growth Factors, and Recent Trends |

| Key Companies Covered | American Express, Bank of America Corporation, Capital One, Mastercard, Payoneer Inc., PayPal Holdings Inc., Square Inc., Stripe, TransferWise Ltd., Visa Inc., and Others. |

| Segments Covered | By Transaction Type, By Business Segment, By Operating Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Customization Scope | Customization for Segments, Region, Country-level will be provided. Avail customized purchase options to meet your exact research needs. Request For Customization |

Global B2B Digital Payment Market: Competitive Players

The significant players driving in the global B2B digital payment market cover

Target market conditions are extremely competitive as a result of the prevalence of market-driving companies. Due to the fact that key companies offer numerous compensations offers and transaction discounts to attract more customers, the B2B payment transaction market is highly competitive.

The global b2b digital payment market is segmented as follows;

By Transaction Type

By Business Segment

By Operating Channel

By Region

Frequently Asked Questions:

What are the key factors driving global B2B digital payment market expansion?

New innovations, regulations, and infrastructure development have rendered B2B digital payment more affordable, efficient, and relevant than ever before as a primary business lever. B2B digital payment has become the largest segment of the global payment market as a result of the development of cutting-edge technologies that are fuelled by B2B payment.

What will be the value of the B2B digital payment market during 2024- 2030?The global B2B digital payment market size was estimated at around $ 982.35 billion in 2023 and is expected to reach a value of $ 2136.92 Billion by 2030, growing at 9.02% CAGR during the forecast period.

Which region will contribute significantly to the revenue of the global B2B digital payment market?

North America is the market leader in B2B payments as a result of the rapid online transitions that are occurring.

What are the key players leveraging B2B digital payment market growth?

The important players driving in the global B2B digital payment market cover American Express, Bank of America Corporation, Capital One, Mastercard, Payoneer Inc., PayPal Holdings Inc., Square Inc., Stripe, TransferWise Ltd., Visa Inc., and Others.

These players adopted different strategies so as to hold major market share in this market. Some of the major players in [keyword] industry includes. [players list]

Based on the [keyword] market analysis, North America is predicted to held the highest share in the [keyword] market during the forecast period.

The statistical data of the top market players of [keyword] industry can be obtained from the company profile section specified in the report. This section incorporates analysis of top player’s operating in the [keyword] industry as well as their last five-year revenue, segmental revenue, product offerings, key strategies adopted, and geographical revenue produced.

The study offers a decisive view on the [keyword] by segmenting the market based on [segment1], [segment2], and region.

The report gives a nitty-gritty assessment of the market by featuring data on various viewpoints that incorporate drivers, restraints, opportunities, and threats. This data can assist stakeholders in making suitable decisions before investing.

The sample for [keyword] market report can be received on-demand from the website as and when required.Direct call services or 24*7 chat support are provided to procure the sample report.

1 Preface

1.Report Description and Scope

2. Research Scope

3. Research Methodology

1. Market Research Process

2. Market Research Methodology

2 Executive Summary

1. B2B Digital Payment Market, 2019-2030 (USD Million)

2. B2B Digital Payment Market: Snapshot

3 B2B Digital Payment - Industry Analysis

1. B2B Digital Payment: Market Dynamics

2. Market Drivers

1. Driver 1

2. .Driver 2

3. Restraints

1. Restraint 1

2. Restraint 2

4. Opportunity

1. Government funding and support

5. Porter’s Five Forces Analysis

6. Market Attractiveness Analysis

1. Market attractiveness analysis By Product Type

2. Market attractiveness analysis By Application

3. Market attractiveness analysis by Region

4. B2B Digital Payment Market - Competitive Landscape

1. Company market share analysis

1. Global B2B Digital Payment Market: company market share, 2020

2. Strategic development

1. Acquisitions & mergers

2. New Product launches

3. Agreements, partnerships, collaborations and joint ventures

4. Research and development and Regional expansion

3. Price trend analysis

5. Global B2B Digital Payment Market -By Transaction Type

1. Global B2B Digital Payment Market overview: By Transaction Type

1. Global B2B Digital Payment Market share, By Product Type,2023 and 2030

2. Traditional

1. Global B2B Digital Payment Market by Traditional, 2019-2030 (USD Million)

3. Digital

1. Global B2B Digital Payment Market by Digital, 2019-2030 (USD Million)

6. Global B2B Digital Payment Market -Business Segment

1. Global B2B Digital Payment Market overview: By Business Segment

1. Global B2B Digital Payment Market share, By Product Type,2023 and 2030

2. Small Sized Business

1. Global B2B Digital Payment Market by Small Sized Business, 2019-2030 (USD Million)

3. Medium Sized Business

1. Global B2B Digital Payment Market by Medium Sized Business, 2019-2030 (USD Million)

4. Large Sized Business

1. Global B2B Digital Payment Market by Large Sized Business, 2019-2030 (USD Million)

7. Global B2B Digital Payment Market -By Operating Channel Analysis

1. Global B2B Digital Payment Market overview: By By Operating Channel

1. Global B2B Digital Payment Market share, By Product Type,2023 and 2030

2. Cross Border

1. Global B2B Digital Payment Market by Cross Border, 2019-2030 (USD Million)

3. Domestic

1. Global B2B Digital Payment Market by Domestic, 2019-2030 (USD Million)

8. Global B2B Digital Payment Market - Regional Analysis

1. Global B2B Digital Payment Market overview: by Region

1. Global B2B Digital Payment Market share, by Region, 2023 and 2030

2. North America

1. North America B2B Digital Payment Market, 2019-2030 (USD Million)

1. North America B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

1. North America B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

1. U.S. B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

2. U.S. B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

3. Canada B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

4. Canada B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

5. Mexico B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

6. Mexico B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

3. Europe

1. Europe B2B Digital Payment Market, 2019-2030 (USD Million)

1. Europe B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

1. Europe B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

1. UK B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

2. UK B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

3. Germany B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

4. Germany B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

5. France B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

6. France B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

7. Italy B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

8. Italy B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

9. Spain B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

10. Spain B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

11. Netherlands B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

12. Netherlands B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

13. Rest of Europe B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

14. Rest of Europe B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

4. Asia Pacific

1. Asia Pacific B2B Digital Payment Market, 2019-2030 (USD Million)

1. Asia Pacific B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

1.Asia Pacific B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

1. China B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

2. China B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

3. Japan B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

4. Japan B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

5. India B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

6. India B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

7. Australia B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

8. Australia B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

9. South East Asia B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

10. South East Asia B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

11.South Korea B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

12. South Korea B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

13. Rest of Asia Pacific B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

14. Rest of Asia Pacific B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

5. Latin America

1. Latin America B2B Digital Payment Market, 2019-2030 (USD Million)

1. Latin America B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

1. Latin America B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

2. Brazil B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

3. Brazil B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

4. Argentina B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

5. Argentina B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

6. Chile B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

7. Chile B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

8. Rest of Latin America B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

9. Rest of Latin America B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

6. Middle East & Africa

1. Middle East & Africa B2B Digital Payment Market, 2019-2030 (USD Million)

2. Middle East & Africa B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

3. Middle East & Africa B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

4. GCC Countries B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

5. GCC Countries B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

6. Nigeria B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

7. Nigeria B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

8. South Africa B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

9. South Africa B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

10. Rest of Middle East & Africa B2B Digital Payment Market revenue, By Product Type, 2019-2030 (USD Million)

11. Rest of Middle East & Africa B2B Digital Payment Market revenue, By Application, 2019-2030 (USD Million)

9. Company Profiles

1. American Express

1. Overview

2. Financials

3. Product Portfolio

4. Business Strategy

5. Recent Developments

2. Bank of America Corporation

1. Overview

2. Financials

3. Product Portfolio

4. Business Strategy

5. Recent Developments

3. Capital One

1. Overview

2. Financials

3. Product Portfolio

4. Business Strategy

5. Recent Developments

4. Mastercard

1. Overview

2. Financials

3. Product Portfolio

4. Business Strategy

5. Recent Developments

5. Payoneer Inc.

1. Overview

2. Financials

3. Product Portfolio

4. Business Strategy

5. Recent Developments

6. PayPal Holdings Inc.

1. Overview

2. Financials

3. Product Portfolio

4. Business Strategy

5. Recent Developments

7. Square Inc.

1. Overview

2. Financials

3. Product Portfolio

4. Business Strategy

5. Recent Developments

8. Stripe

1. Overview

2. Financials

3. Product Portfolio

4. Business Strategy

5. Recent Developments

9. TransferWise Ltd.

1. Overview

2. Financials

3. Product Portfolio

4. Business Strategy

5. Recent Developments

10. Visa Inc.

1. Overview

2. Financials

3. Product Portfolio

4. Business Strategy

5. Recent Developments

List of Figures

Market research process

Market research methodology

Global B2B Digital Payment Market, 2019-2030 (USD Million)

Porter’s Five Forces Analysis

Global B2B Digital Payment Market attractiveness, By Transaction Type

Global B2B Digital Payment Market attractiveness, By Business Segment

Global B2B Digital Payment Market attractiveness, By Operating Channel

Global B2B Digital Payment market share, By Transaction Type, 2023 and 2030

Global B2B Digital Payment Market by Traditional, 2019-2030 (USD Million)

Global B2B Digital Payment Market by Digital, 2019-2030 (USD Million)

Global B2B Digital Payment market share, By Business Segment, 2023 and 2030

Global B2B Digital Payment Market by Small Sized Business, 2019-2030 (USD Million)

Global B2B Digital Payment Market by Medium Sized Business, 2019-2030 (USD Million)

Global B2B Digital Payment Market by Large Sized Business, 2019-2030 (USD Million)

Global B2B Digital Payment market share, By Operating Channel, 2023 and 2030

Global B2B Digital Payment Market by Cross Border, 2019-2030 (USD Million)

Global B2B Digital Payment Market by Domestic, 2019-2030 (USD Million)

North America B2B Digital Payment Market, 2019-2030 (USD Million)

Europe B2B Digital Payment Market, 2019-2030 (USD Million)

Asia Pacific B2B Digital Payment Market, 2019-2030 (USD Million)

Latin America B2B Digital Payment Market, 2019-2030 (USD Million)

Middle East & Africa B2B Digital Payment Market, 2019-2030 (USD Million)

List of Tables

Global B2B Digital Payment Market: snapshot

Drivers of the B2B Digital Payment Market: impact analysis

Restraints of the B2B Digital Payment Market: impact analysis

North America B2B Digital Payment Market revenue, By Product Type,2019-2030 (USD Million)

North America B2B Digital Payment Market revenue, By Application,2019-2030 (USD Million)

Europe B2B Digital Payment Market revenue, By Product Type,2019-2030 (USD Million)

Europe B2B Digital Payment Market revenue, By Application,2019-2030 (USD Million)

Asia Pacific B2B Digital Payment Market revenue, By Product Type,2019-2030 (USD Million)

Asia Pacific B2B Digital Payment Market revenue, By Application,2019-2030 (USD Million)

Latin America B2B Digital Payment Market revenue, By Product Type,2019-2030 (USD Million)

Latin America B2B Digital Payment Market revenue, By Application,2019-2030 (USD Million)

Middle East & Africa B2B Digital Payment Market revenue, By Product Type,2019-2030 (USD Million)

Middle East & Africa B2B Digital Payment Market revenue, By Application,2019-2030 (USD Million)

1.1 Research Methodology

The process of market research at Syndicate Market Research is an iterative in nature and usually follows following path. Information from secondary is used to build data models, further the results obtained from data models are validated from primary participants. Then cycle repeats where, according to inputs from primary participants, additional secondary research is done and new information is again incorporated into data model. The process continues till desired level of information is not generated.

To calculate the market size, the report considers the revenue generated from the sales of the market providers. The revenue generated from the sales of market is calculated through primary and secondary research. The key players operating in the market across the globe are identified through secondary research and a corresponding detailed analysis of the top vendors in the market is done. The market size calculation also includes clinical trial phase segmentation determined using secondary sources and verified through primary sources.

1.2 Secondary Research

The secondary research sources that are typically referred to include, but are not limited to:

The sources for secondary research includes but is not limited to: Factiva, Hoovers and Statista

1.3 Primary Research

We conduct primary interviews on an ongoing basis with industry participants and commentators in order to validate data and analysis. A typical research interview fulfills the following functions:

The participants who typically take part in such a process include, but are not limited to:

1.4 Models

Where no hard data is available, we use modeling and estimates in order to produce comprehensive data sets. A rigorous methodology is adopted in which the available hard data is cross referenced with the following data types to produce estimates:

Data is then cross checked by the expert panel.

1.4.1 Company Share Analysis Model

Company share analysis is used to derive the size of global market. As well as study of revenues of companies for last three to five years also provide the base for forecasting the market size and its growth rate. This model is built in following steps:

1.4.2 Revenue Based Modeling

Revenue based models can be built in two ways - Top-Down or Bottom-Up irrespective of industry. Market size estimated from company share analysis acts as a validation point for bottom-up approach where as it acts as starting point for top-down approach.

1.5 Research Limitations

Inflation is not a part of pricing in this report. Prices of the products and its derivatives vary in each region and hence similar revenue ratio does not follow for each individual region. The same price for each type has been taken into account while estimating and forecasting market revenue on a global basis. Regional average price has been considered while breaking down this market by end user in each region.

We focus on the quality and accuracy of the report

Our expert team will assist with all your research needs and customize the report

Get you queries resolved from our expert analysts before and after purchasing the report

Instant delivery in the form of a PDF/PPT/Word Doc to your email address, within 12 hours after receiving the full payment.

Analysts will provide deep insights about the reports

* We value your privacy and will never rent or sell your email address.

Comprehensive & Focused Market Reports Large Archive of Excellent Market and Industry Analysis Reports that Deliver Business Intelligence.

Safe & Secure Payment Solutions

Enabled by SSL, we provide you numerous safe payment options for

risk-free transactions.

Superior Customer Experience We serve our

customers through calls, emails and live chats for 365 days, 24x7.