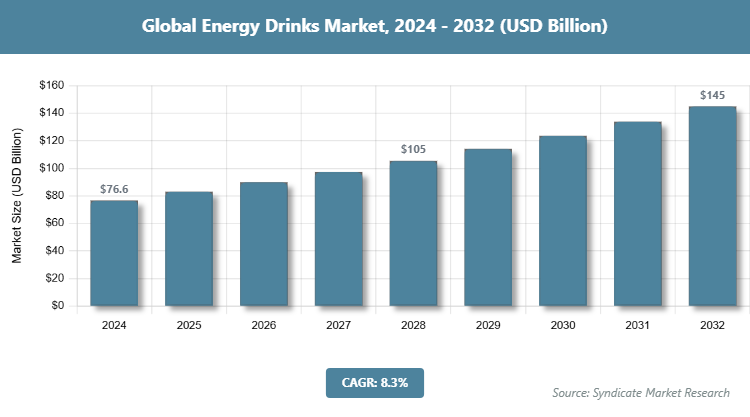

According to Syndicate Market Research, the global energy drinks market was valued at around USD 76.56 Billion in 2024 and is projected to expand from USD 82.91 Billion in 2025 to USD 144.89 Billion by 2032, achieving a compound annual growth rate (CAGR) of approximately 8.3% from 2026 to 2032. This comprehensive energy drinks industry research report delivers a detailed, step-by-step analysis of the market landscape, providing essential insights for stakeholders, investors, and industry leaders. The study encompasses key elements such as market size, primary growth drivers, emerging trends, competitive forces, and long-term forecasts to guide strategic decision-making.

Industry Insights

The energy drinks market has been on an upward trajectory in recent years, driven by the growing demand for beverages that provide an instant energy boost. These drinks have become popular among consumers seeking quick revitalization, often in the form of caffeine and other stimulating ingredients. The industry is characterized by a dynamic consumer base and constant innovation to meet evolving preferences.

Market Overview

The global energy drinks market, with a valuation of USD 36.74 billion in 2023 and is estimated to reach a value of USD 74.82 billion, is poised for significant expansion at a compound annual growth rate (CAGR) of 8.5% from 2024 to 2030. This growth is primarily attributed to the increasing demand for energy drinks as potential enhancers of both physical and cognitive performance.

Consumers are increasingly turning to energy drinks as a means to boost their energy levels and enhance alertness. Notably, there is a growing preference for energy drinks that are free from sugar, glucose, and high fructose corn syrups. These healthier alternatives have garnered substantial attention among consumers who prioritize their well-being.

Market players have responded by actively promoting these drinks as functional beverages capable of not only providing an energy lift but also improving overall physical vitality. This shift towards healthier and more functional options reflects the evolving preferences of consumers in the energy drinks market.

Key Insights

Global Energy Drinks Market 2024 Size By Region

Get more information about this report - Request Free Sample Copy

Market Dynamics

Energy Drinks Market: Key Growth Drivers

Increasing Health Awareness

A growing focus on health and wellness has prompted consumers to seek energy drinks with healthier formulations. Products with reduced sugar, natural ingredients, and functional benefits are gaining traction. Manufacturers are adapting by introducing healthier variants, creating opportunities for growth and catering to evolving consumer preferences.

Sports and Fitness Enthusiasts

Energy drinks are increasingly used by athletes and fitness enthusiasts to enhance performance and endurance. These consumers value the stimulant effects of caffeine and other performance-enhancing ingredients. The sports and fitness segment presents a lucrative market niche, with the potential for targeted product development and marketing.

Changing Lifestyles and Hectic Routines

Modern lifestyles characterized by fast-paced routines, long working hours, and increased stress levels have led consumers to seek quick energy solutions. Energy drinks offer a convenient source of instant vitality, driving their popularity. The demand for energy drinks is expected to rise as urbanization and hectic lifestyles persist.

Energy Drinks Market: Restraints

Health Concerns and Regulatory Scrutiny

Concerns about the health impacts of excessive energy drink consumption have led to increased regulatory scrutiny. Associations with adverse health effects such as heart palpitations, insomnia, and addiction have raised alarms. Stricter regulations and negative consumer perceptions can limit market growth and create challenges for manufacturers.

Competition from Alternatives

Energy drinks face competition from alternative beverages such as coffee, tea, and natural energy-boosting options. These alternatives often have healthier reputations. The availability of substitutes may impact market share and necessitate product differentiation to maintain competitiveness.

Energy Drinks Market: Opportunities

Innovative Ingredients

Ongoing research into innovative and natural ingredients presents opportunities for the development of healthier and more appealing energy drink formulations. Ingredients such as adaptogens, vitamins, and herbal extracts are gaining interest. Manufacturers can seize the opportunity to create unique products that cater to health-conscious consumers.

Emerging Markets

Untapped markets in developing regions, where awareness of energy drinks is still growing, represent a significant growth opportunity. Rising disposable incomes and urbanization are driving demand in these regions. Expansion into emerging markets can result in substantial market share gains for energy drink companies.

Energy Drinks Market: Challenges

Regulatory Challenges

The energy drinks industry faces the challenge of complying with evolving and varying regulatory frameworks in different regions. Regulations related to labelling, ingredient safety, and marketing practices are subject to change. Navigating complex regulatory landscapes can be resource-intensive and require continuous adaptation.

Consumer Perception

Overcoming negative perceptions associated with energy drinks, particularly concerning health risks, is an ongoing challenge. Public awareness campaigns highlighting potential health concerns can impact consumer choices. Companies must invest in education and communication strategies to address consumer concerns and maintain trust.

Energy Drinks Market: Segmentation Analysis

This comprehensive market research report delves into the segmentation analysis of the global energy drinks market, providing valuable insights into how the market is divided based on various factors. Understanding these segments is crucial for businesses to target their products effectively and cater to specific consumer preferences.

By Product Type Segmentation Analysis

Traditional Energy Drinks:

Traditional energy drinks contain caffeine, taurine, and a lot of sugar. These drinks have led the energy drink market for years due to their fast energy boost.

Natural and Low-Calorie Variants:

Energy drink consumers are choosing natural, low-calorie options as they become more health conscious. In addition to less sugar and other ingredients, these versions often contain vitamins, minerals, and adaptogens. They appeal to health-conscious consumers who want to improve their energy without compromising their wellness aims.

By Distribution Channel Segmentation Analysis

Retail Stores:

Energy drinks are typically sold at supermarkets, convenience stores, and gas stations. Retailers sell energy drinks. They offer convenience and a variety of brands and flavors.

Online Retailing:

The growth of e-commerce has provided energy drink makers with new channels via which they may connect with consumers all over the world. Customers have easier access to a wider variety of energy drink options and greater convenience when they shop for these items through online retailers.

On-Premises (Bars and Clubs):

In pubs and nightclubs all over the world, energy drinks are frequently utilized as mixers in alcoholic beverages. This market sector serves consumers who want to maintain their energy and alertness while engaging in evening activities or attending social gatherings.

Recent Developments

| Report Attributes | Report Details |

|---|---|

| Report Name | Energy Drinks |

| Market Size in 2023 | USD 36.74 billion |

| Market Forecast in 2030 | USD 74.82 billion |

| Growth Rate | CAGR of 8.5% |

| Number of Pages | 130 |

| Key Companies Covered | Amway, AriZona Beverages USA, The Coca-Cola Company, Living Essentials LLC, Lucozade, Monster Energy, PepsiCo, Inc., Red Bull, Taisho Pharmaceutical Co. Ltd., Xyience Energy. |

| Segments Covered | By Product Type, By Distribution Channel |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Regional Analysis

North America:

North America represents a significant share of the global energy drinks market. Consumer demand for energy drinks remains robust, with a focus on both traditional and healthier options. Regulatory scrutiny has led to label changes and reduced caffeine content in some products.

Europe:

Europe has a diverse energy drinks market. Health and wellness trends have driven the demand for natural and low-calorie variants. The region has also been at the forefront of stricter regulations regarding labeling and marketing in the industry.

Asia-Pacific:

The Asia-Pacific region is witnessing rapid growth in the energy drinks market. Urbanization, changing lifestyles, and increased disposable income have boosted demand. Manufacturers are also introducing products tailored to regional tastes and preferences.

Latin America:

Latin America is an emerging market for energy drinks. Rising incomes and changing consumption patterns are driving demand in this region. Energy drink manufacturers are exploring opportunities to expand their presence here.

Middle East & Africa:

The Middle East & Africa region is experiencing steady growth in the energy drinks market. The urbanization and expanding consumer base are contributing to this growth. However, the market faces challenges related to regulatory variations across countries in the region.

Competitive Analysis

Key players in the energy drinks market include Red Bull GmbH, Monster Energy Company, PepsiCo Inc. (Rockstar Energy), The Coca-Cola Company (Coca-Cola Energy), and others. These companies are investing in product innovation, marketing, and expanding their distribution networks to maintain their competitive positions. Smaller, niche players are also gaining ground by offering unique formulations and catering to specialized consumer segments.

The global energy drinks market segmented as follows,

By Product Type

By Distribution Channel

By Region

These players adopted different strategies so as to hold major market share in this market. Some of the major players in Energy Drinks industry includes.

Based on the Energy Drinks market analysis, North America is predicted to held the highest share in the Energy Drinks market during the forecast period.

The statistical data of the top market players of Energy Drinks industry can be obtained from the company profile section specified in the report. This section incorporates analysis of top player’s operating in the Energy Drinks industry as well as their last five-year revenue, segmental revenue, product offerings, key strategies adopted, and geographical revenue produced.

The study offers a decisive view on the Energy Drinks by segmenting the market based on Product Type, Application, and region.

The report gives a nitty-gritty assessment of the market by featuring data on various viewpoints that incorporate drivers, restraints, opportunities, and threats. This data can assist stakeholders in making suitable decisions before investing.

The sample for Energy Drinks market report can be received on-demand from the website as and when required.Direct call services or 24*7 chat support are provided to procure the sample report.

List of Figures

List of Tables

1.1 Research Methodology

The process of market research at Syndicate Market Research is an iterative in nature and usually follows following path. Information from secondary is used to build data models, further the results obtained from data models are validated from primary participants. Then cycle repeats where, according to inputs from primary participants, additional secondary research is done and new information is again incorporated into data model. The process continues till desired level of information is not generated.

To calculate the market size, the report considers the revenue generated from the sales of the market providers. The revenue generated from the sales of market is calculated through primary and secondary research. The key players operating in the market across the globe are identified through secondary research and a corresponding detailed analysis of the top vendors in the market is done. The market size calculation also includes clinical trial phase segmentation determined using secondary sources and verified through primary sources.

1.2 Secondary Research

The secondary research sources that are typically referred to include, but are not limited to:

The sources for secondary research includes but is not limited to: Factiva, Hoovers and Statista

1.3 Primary Research

We conduct primary interviews on an ongoing basis with industry participants and commentators in order to validate data and analysis. A typical research interview fulfills the following functions:

The participants who typically take part in such a process include, but are not limited to:

1.4 Models

Where no hard data is available, we use modeling and estimates in order to produce comprehensive data sets. A rigorous methodology is adopted in which the available hard data is cross referenced with the following data types to produce estimates:

Data is then cross checked by the expert panel.

1.4.1 Company Share Analysis Model

Company share analysis is used to derive the size of global market. As well as study of revenues of companies for last three to five years also provide the base for forecasting the market size and its growth rate. This model is built in following steps:

1.4.2 Revenue Based Modeling

Revenue based models can be built in two ways - Top-Down or Bottom-Up irrespective of industry. Market size estimated from company share analysis acts as a validation point for bottom-up approach where as it acts as starting point for top-down approach.

1.5 Research Limitations

Inflation is not a part of pricing in this report. Prices of the products and its derivatives vary in each region and hence similar revenue ratio does not follow for each individual region. The same price for each type has been taken into account while estimating and forecasting market revenue on a global basis. Regional average price has been considered while breaking down this market by end user in each region.

We focus on the quality and accuracy of the report

Our expert team will assist with all your research needs and customize the report

Get you queries resolved from our expert analysts before and after purchasing the report

Instant delivery in the form of a PDF/PPT/Word Doc to your email address, within 12 hours after receiving the full payment.

Analysts will provide deep insights about the reports

* We value your privacy and will never rent or sell your email address.

Comprehensive & Focused Market Reports Large Archive of Excellent Market and Industry Analysis Reports that Deliver Business Intelligence.

Safe & Secure Payment Solutions

Enabled by SSL, we provide you numerous safe payment options for

risk-free transactions.

Superior Customer Experience We serve our

customers through calls, emails and live chats for 365 days, 24x7.